Heavy truck sales stabilize the rubber tire market outlook is worth looking forward to

In October 2012, the sales volume of heavy-duty trucks was 44,000 units, a year-on-year increase of 1.9%. Sales volume stabilized at 40,000 units for two consecutive months, and sales volume stabilized and picked up. Due to heavy truck consumption of rubber is far more than in other types of vehicles, so heavy truck production and sales data has been a lot of influence on the rubber tire industry. If there is a recovery in the production and sales of heavy trucks, it will greatly benefit the rubber market.

From January to October in 2012, auto manufacturers reduced their inventory by 40,000 units, of which October data showed that the difference between production and sales of heavy trucks was 2,546 units, reflecting that the vendor level still maintained a more cautious attitude. However, starting from July, the absolute value of the single-month production and sales difference of heavy trucks has a significant downward trend, indicating that the inventory pressure of manufacturers has been reduced, and the terminal demand has shown signs of improvement. After experiencing the traditional peak season of “golden nine silver and ten silverâ€, heavy trucks have shown steady growth, sales have basically bottomed out, and the downside is quite limited in the future. Because of the technical level and working environment restrictions, domestic heavy trucks have an update cycle of 3-5 years. They experienced the blowout of heavy truck consumption in 2009 and 2010, and they have gradually entered the peak period of renovation. Therefore, the outlook for consumption is worth looking forward to.

In 2012, when the price of rubber upstream fell into a dilemma, the profitability of downstream tires increased. Since the cancellation of the related preferential policies, the automobile market has suffered from weak growth due to the overall economic slowdown, and the operating rate of tire manufacturers has dropped. Rubber is the main raw material of tires, and the proportion of rubber used in all-steel tires is about 40%-50%. The weak demand has caused the price of tires to fall, and it has also impacted the prices of raw materials upstream. According to calculations, when the rubber price fell by 40%, the cost of domestic car and passenger car tires fell by about 27%. In the event that the price drop of tires was lower than the cost reduction, tire companies still managed to obtain profitability under the situation that the downstream demand was weak. Promote. In addition to heavy truck sales will be stabilized, tire companies also ushered in the US special security case expiration of this favorable factor, making tire companies in the future will start a certain increase in operating rates, tire companies have more export cost advantages, boost rubber Demand.

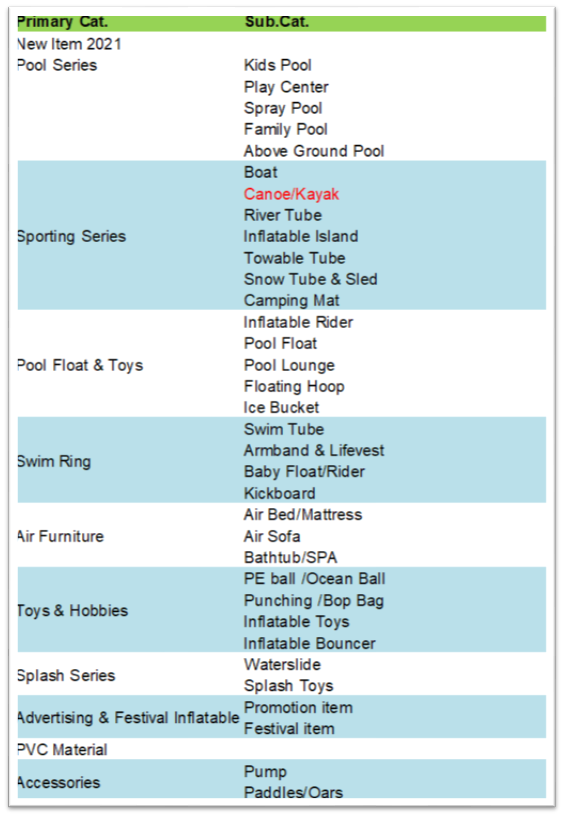

PD Toys plastic Co., Ltd is OEM & ODM manufacturer of inflatable products in the mainland of China with more 17 years of manufacturing experience. products ranges are Inflatable Toys, inflatable pools, inflatable pool floats, towable tubes, Air Furniture and Promotional Items etc. total have more than 1500 employees (4 factories) related to PVC inflatable products.

Operated under ISO 9001:2015 management system, We had passed factory Audit by Walmart, Taret, Disney ect, also passed all necessary certificates and testing such as ICTI, BSCI, SEMTA,Target FA, NBC Universal, FCCA, SGS, CVS Security, GSV, Disney FAMA ect. We have our own PVC raw materials manufacturing company, all the PVC we produced are compliance with European EN71, American ASTM standard and NON PHTHALATE (6P) standard.

Inflatable Waterslide,Water Slide,Inflatable Slip N Slide,Inflatable Slide

P&D Plastic Manufacture Co., Ltd , https://www.jminflatablepool.com